In May 2019, Mazda declared its endorsement of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)*1 and joined the TCFD Consortium,*2 thereby showing its commitment to ramping up its efforts to address climate change. Going forward, we will continue to proactively disclose information based on the TCFD recommendations.

TCFD

Basic Approach

For more information on Mazda's basic approach with regard to climate change, please refer to the Climate Change section of its sustainability website.

*1 The TCFD is a private-sector organization set up by the Financial Stability Board in response to a request from the G20 Finance Ministers and Central Bank Governors.

*2 The TCFD Consortium is an organization established in Japan for the purpose of holding discussions on effective corporate information disclosure related to climate change and efforts to link disclosed information to appropriate investment decision-making by financial institutions and other entities. The Ministry of Economy, Trade and Industry, the Financial Services Agency, and the Ministry of the Environment participate in the consortium as observers.

Governance

a) Board's oversight of climate-related risks and opportunities

b) Management's role in assessing and managing climate-related risks and opportunities

Transition Risks

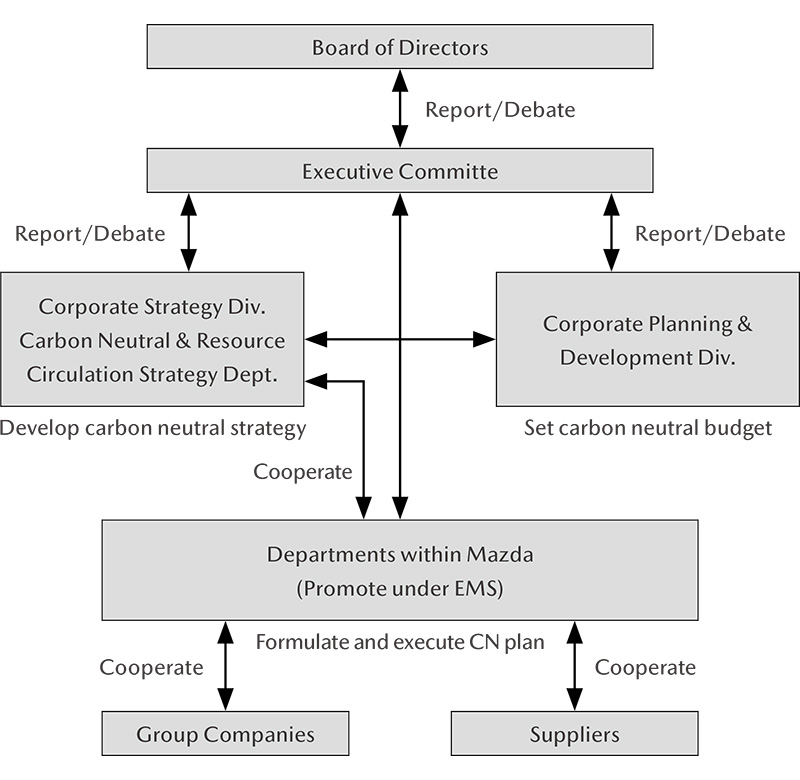

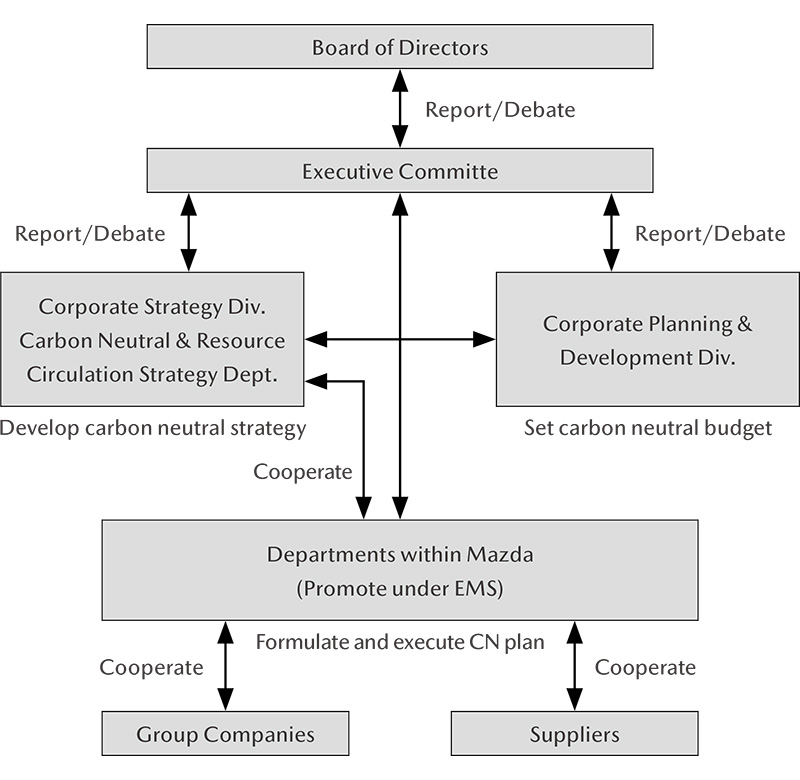

At Mazda, the Board of Directors appoints an officer responsible for overseeing and promoting carbon neutrality strategies. This individual heads a dedicated department that has been set up within the Corporate Strategy Division to formulate carbon neutrality strategies and lead internal organizations in implementing these strategies. The Company has integrated the management of carbon neutrality-related processes into its ISO 14001-compliant environmental management system in order to more effectively promote business activities that are considerate of the environment at all Group companies and across the entire supply chain. Carbon neutrality action plans are drafted and enacted by the relevant internal divisions, and the twice-annual Carbon Neutrality Promotion Meeting, which is attended by the officer responsible for carbon neutrality-related matters, is used as an opportunity to share information on the progress of carbon neutrality initiatives. Carbon neutrality strategies, climate change, and other sustainability issues are reported and discussed at Executive Committee Meetings and meetings of the Board of Directors, in which the president participates.*

* Sustainability issues had been reported and discussed at Board of Directors' meetings nine times as of May 2025.

Carbon Neutrality Initiative Management System

Role of the Board of Directors

The Board of Directors deliberates and makes decisions on important operational execution matters, such as responses to climate change and other aspects of management strategies and basic management policies. This organization also supervises the execution of duties by individual directors.

<Major Climate Change-Related Matters Discussed in FY March 2025>

- Strategies and initiatives for phased transition to electrification based on market-specific trends and other specific conditions

- Collaboration with partners to promote the electrification of vehicles through means such as the procurement of automotive batteries and the introduction of battery electric vehicles

- Investment in production of in-house battery electric vehicles

■Director Skills Matrix

Mazda seeks to enhance the effectiveness of its efforts to address climate change and other environmental, social, and governance (ESG) issues. To this end, the Company has included ESG among the items of its director skills matrix to guide it in appointing directors who possess the experience and expertise necessary to appropriately supervise the promotion of sustainability initiatives.

Skills Matrix of the Board of Directors (Corporate Governance)

■Incorporation of Climate Change Targets into Executive Remuneration System

In June 2024, the Company established four climate change-related performance indicators, including the reduction of greenhouse gas emissions, for use in determining performance share unit remuneration. The number of shares to be issued is determined based on whether the target for each performance indicator has been achieved.

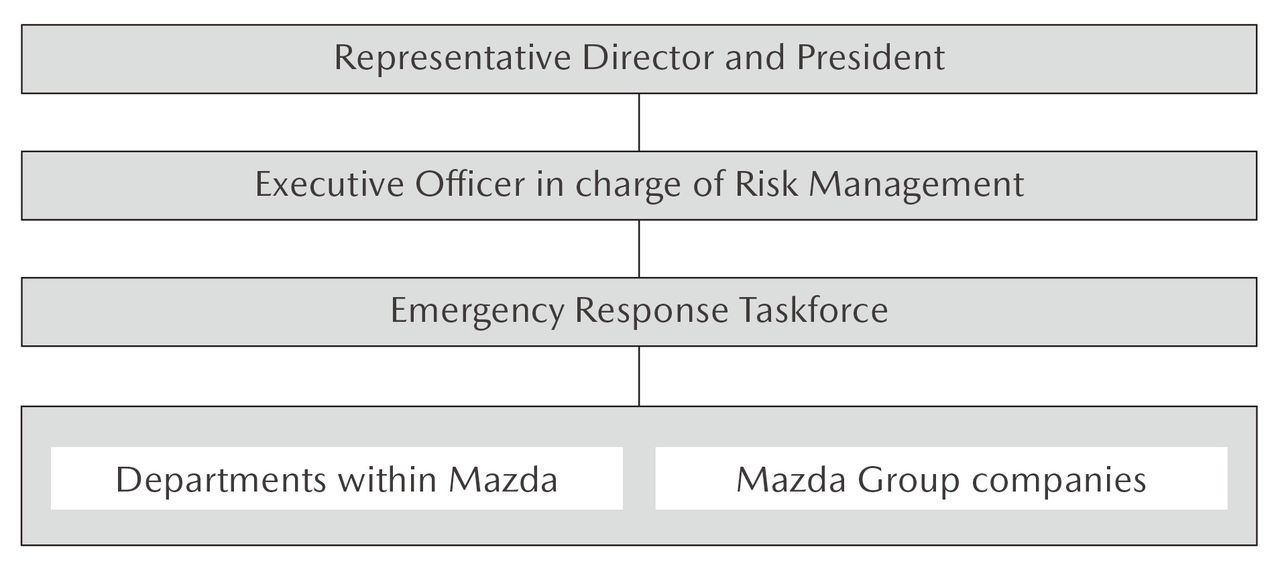

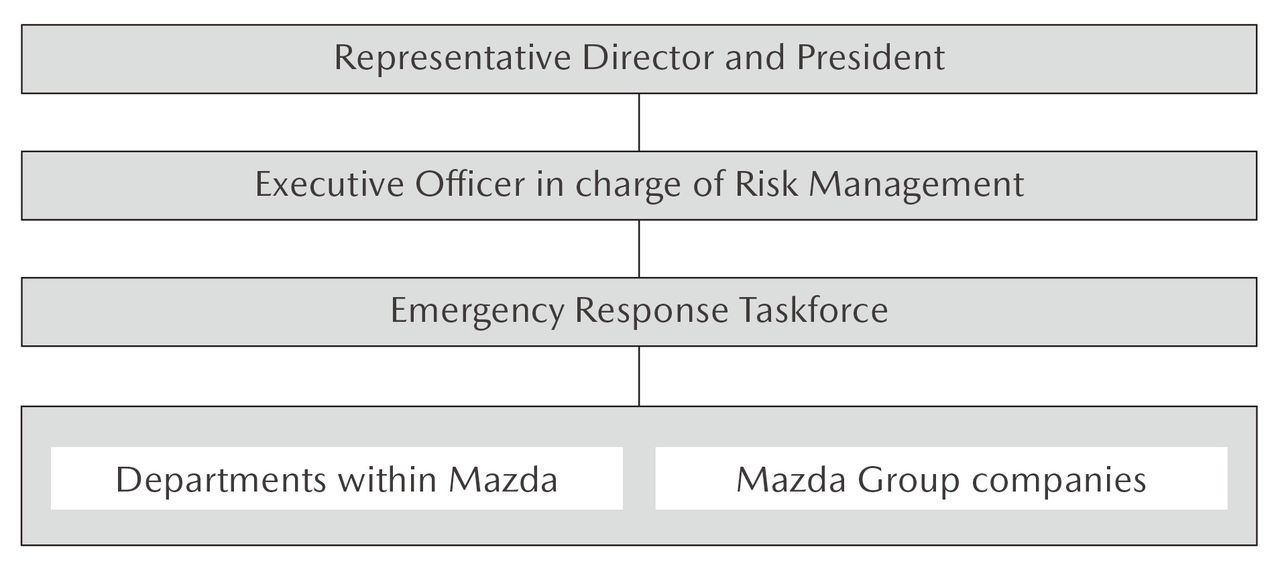

Physical Risks

Measures for responding to physical risks, such as those of torrential rains, an acute physical risk associated with climate change, are managed through an emergency risk management structure as part of the Company's business continuity plan (BCP). In addition, the Company is promoting the reinforcement of seawall infrastructure and water resource conservation efforts through dedicated divisions in response to concerns about storm surges and water depletion, which are chronic physical risks.

Emergency Risk Management Structure

In the event of an incident that falls outside the scope of existing risk management organizations and requires a coordinated interdepartmental response, the executive officer in charge of risk management will consult with the president and then establish an emergency response taskforce and appoint a leader for this taskforce.

Strategy

a) Climate-related risks and opportunities identified for the short, medium, and long term

b) Impact of climate-related risks and opportunities on business, strategy, and financial planning

c) Resilience of strategies based on climate-related scenarios

With reference to the scenarios released by the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IEA), policy and regulatory trends, and industry trends, Mazda has formulated a scenario based on its own assumptions, which the Company has used to identify the following major opportunities and risks.

■Major Risks and Opportunities

| Transition Risks | Policy and Legal |

|

|---|---|---|

Technology |

|

|

| Market |

|

|

| Reputation |

|

|

| Physical Risks | Acute |

|

| Chronic |

|

|

| Opportunities | Resource Efficiency |

|

| Energy Resource |

|

|

| Products, Services, and Markets |

|

■Measures for Capitalizing on Opportunities and Avoiding or Minimizing Risks

| Area | Initiatives | |

|---|---|---|

| Capitalization on opportunities, Transition risk avoidance | Creation (Production) | Advancement of initiatives based on following three pillars:

(1) Energy conservation

(2) Shift to renewable energy

(3) Introduction of carbon-neutral fuels

|

| Transportation (Logistics) |

|

|

| Use (Products) | Development of carbon-neutral vehicles

Expansion of use of carbon-neutral fuel |

|

| Return (Resource circulation) | ||

| Physical risk evasion and minimization | Establishment of systems for rapid response to torrential rains, etc. |

|

| Future-oriented measures for maintaining seawalls |

|

|

| Water resources conservation in preparation for water resources depletion |

|

Risk Management

a) Processes for identifying and assessing climate-related risks

b) Climate-related risk management processes

c) Status of integration of climate-related risk management processes into overall risk management

<Transition Risks>

Mazda has identified major risks and opportunities based on scenarios released by the IPCC and the IEA, government policies, and regulatory and industry trends, and is advancing initiatives to capitalize on the identified opportunities and avoid the indicated risks. Strategies derived from these processes are discussed at Executive Committee Meetings and meetings of the Board of Directors, both of which are attended by the president. Mazda also regularly shares climate-related information with suppliers through a shared platform.

<Physical Risks>

- Mazda has established a system for rapid response to torrential rain and other natural disasters. These risks are managed through an emergency risk management system as part of our BCP. In addition to these efforts, the Company has been taking steps to enhance its ability to collect weather forecast information and facilitate making quick disaster prevention decisions based on a predetermined time schedule. These steps are being taken in response to the recent rise in the frequency and severity of torrential rain disasters. Moreover, the Company's response measures are reviewed every heavy rain season to improve response capabilities.

- In response to concerns about storm surges and water resources depletion, Mazda is promoting the reinforcement of seawall infrastructure and water conservation efforts by dedicated departments.

- To combat the heat waves that have become more frequent in recent years, we regularly measure and evaluate the heat environment of each workplace as part of employee health management, and the information gained is used to guide the appropriate maintenance and management of air conditioning equipment. In addition, we use heat-insulating materials and heat-insulating paints in our buildings as part of our eco-friendly measures.

- Measures against the spread of epidemics include the implementation of workplace guidelines providing support when an employee or a member of their family residing with them has become infected.

Metrics and Targets

a) Metrics used to assess climate-related risks and opportunities

b) Scope 1, Scope 2, and Scope 3 greenhouse gas emissions and related risks

c) Targets and performance for managing climate-related risks and opportunities

<Global Warming Response>

Achieving carbon neutrality throughout Mazda's entire supply chain by 2050 will require the Company to track Scope 1, Scope 2, and Scope 3 greenhouse gas emissions. To facilitate these efforts, Mazda has defined metrics and targets, and is managing progress toward these goals through a plan-do-check-act (PDCA) cycle. Furthermore, we officially participated in the GX League* sponsored by the Ministry of Economy, Trade and Industry, in May 2023. As part of this participation, Mazda will present its emission reduction targets for domestic factories and operating sites and disclose progress toward these targets through the GX dashboard.

* The GX League is an organization that aims to provide value for social structural reform toward carbon neutrality together with member companies through the four initiatives of voluntary emission trading (implementation), market rule formation (co-creation), business opportunity creation (dialogue), and "GX studios" (exchange). "GX" is an abbreviation for "green transformation."

■Major Metrics and Targets

| FY March 2026 target | Reduce Mazda's non-consolidated CO₂ emissions by 27% compared to FY March 2014 |

|---|---|

| FY March 2031 target | Reduce Mazda's non-consolidated CO₂ emissions by 46% or more compared to FY March 2014 |

| 2035 target | Achieve carbon neutrality at Mazda's global factories |

| 2050 target | Achieve carbon neutrality across the entire supply chain |

Roadmap for Achieving Carbon Neutrality

As a milestone on its road to achieving carbon neutrality throughout the entire supply chain by 2050, Mazda will endeavor to achieve carbon neutrality at its factories worldwide by 2035. To guide us toward this goal, in September 2025 we updated our road map and medium-term target for FY March 2031 at Mazda factories and offices in Japan, which account for approximately 75% of total CO₂ emissions. This update was meant to facilitate more flexible responses in light of trends in the alternative fuel procurement and technological advancements.

As part of its measures for working toward this goal, Mazda switched the fuel used to supply the in-house power generation facilities at the Hiroshima Plant, Ujina District from the originally planned coal to ammonia. However, we now plan to transition to a gas cogeneration system fueled by city gas produced using liquefied natural gas (LNG) to more steadily pursue decarbonization. This system will allow us to undertake a phased shift toward hydrogen fuel, which is gaining attention as a carbon-neutral form of fuel, with only small-scale equipment renovations. In this manner, we look to promote decarbonization in step with society's future adoption of carbon-neutral fuels.

In conjunction with the introduction of this system, the coal-fired thermal power generation systems currently in operation at the Hiroshima Plant and the Hofu Plant are schedule to be decommissioned around 2030. Moreover, the update to the road map entailed reassessing our interim CO₂ emissions reduction target for FY March 2031 and resulted in us announcing a new target of a reduction of 46% or more in comparison to FY March 2013 in line with the Japanese national target. This target replaces the prior target of a 69% reduction from the same year.

Scope 1 and Scope 2 Greenhouse Gas Emissions Targets (Domestic factories and offices, values registered with GX League)

| Unit | FY March 2014 (base year) |

FY March 2026 targets |

FY March 2031 targets |

2050 target |

|

|---|---|---|---|---|---|

| Total (Scope 1 + Scope 2) |

1,000t-CO₂e | 854 | 625 | 461 | Net-zero CO₂ emissions |

| Reduction (from FY March 2014) | % | - | 27 | 46 |

Scope: Sites including Mazda's Head Office and Hiroshima Plant (Aki-gun and Hiroshima City in Hiroshima Prefecture), Hofu Plant (Hofu City, Yamaguchi Prefecture), and Miyoshi Plant (Miyoshi City, Hiroshima Prefecture)

■Progress Related to Carbon Neutrality Metrics and Targets

Global*

Scope 1, Scope 2, and Scope 3 Greenhouse Gas Emissions

| Unit | FY March 2021 | FY March 2022 | FY March 2023 | FY March 2024 | FY March 2025 | ||

|---|---|---|---|---|---|---|---|

| Scope 1 | 1,000t-CO₂e | 97 | 97 | 113 | 112 | 119 | |

| Scope 2 (market basis) | 1,000t-CO₂e | 736 | 739 | 754 | 815 | 776 | |

| Scope 3 | Category 11 | 1,000t-CO₂e | 27,386 | 25,777 | 26,081 | 55,240 | 57,574 |

| Other categories | 1,000t-CO₂e | 4,217 | 4,020 | 4,441 | 4,809 | 4,507 | |

| Total | 1,000t-CO₂e | 32,436 | 30,633 | 31,389 | 60,976 | 62,978 | |

* Scope for FY March 2025

Scope 1 and Scope 2: Mazda Motor Corporation, 20 domestic consolidated subsidiaries, 10 domestic equity-method affiliates, 24 overseas consolidated subsidiaries, and four overseas equity-method affiliates

Scope 3:

・Categories 1, 2, 6, and 7: Mazda Motor Corporation

・Category 3: Four Mazda Motor Corporation domestic production sites and six overseas production companies (two consolidated subsidiaries and four equity-method affiliates)

・Categories 4 and 9: Mazda Motor Corporation, 20 domestic consolidated subsidiaries, and 10 domestic equity-method affiliates

・Category 5: Four Mazda Motor Corporation domestic production sites

・Categories 8, 10, 13, 14, and 15: Mazda Motor Corporation, 20 domestic consolidated subsidiaries, 10 domestic equity-method affiliates, 24 overseas consolidated subsidiaries, and four overseas equity-method affiliates

・Categories 11 and 12: All vehicles sold by Mazda (including those produced by OEMs)

Note: For Category 11, the following revisions were implemented to the calculation method in FY March 2023 in order to improve comprehensiveness and accuracy.

- Prior to 2022: Calculated based on vehicle sales volumes in Japan and major sales regions (North America, Europe, and China) using the Tank-to-Wheel (fuel consumption during driving) method

- From 2023 forward: Calculated based on global production volume using the Well-to-Wheel (fuel extraction, refining, and electricity generation and fuel consumption during driving) method Emissions for FY March 2024 calculated using the previous calculation method amount to 29,763 (1,000t-CO₂e). The increase in emissions is primarily due to an increase in sales volume (approximately 12% year on year).

Ratios of Electric Vehicle Sales to Global Sales Volume*

| Unit | FY March 2024 | FY March 2025 | |||

|---|---|---|---|---|---|

| Sales volume | % of total sales | Sales volume | % of total sales | ||

| Electric vehicles | Units/% | 272,831 | 22.0 | 340,336 | 26.1 |

| Hybrid electric vehicles | Units/% | 230,969 | 18.6 | 289,898 | 22.3 |

| Plug-in hybrid electric vehicles | Units/% | 34,149 | 2.8 | 45,210 | 3.5 |

| Battery electric vehicles | Units/% | 7,713 | 0.6 | 5,228 | 0.4 |

| Internal combustion engine vehicles | Units/% | 967,837 | 78 | 962,208 | 73.9 |

| Total | Units/% | 1,240,668 | 100 | 1,302,544 | 100 |

* Sales volume includes OEM units. Hybrid electric vehicles includes mild hybrids.

Directly Operated Factories Worldwide*

Scope 1 and Scope 2 Greenhouse Gas Emissions

| Unit | FY March 2014 (base year) |

FY March 2023 | FY March 2024 | FY March 2025 | |

|---|---|---|---|---|---|

| Directly operated factories worldwide | 1,000t-CO₂e | 928 | 785 | 802 | 778 |

| Reduction (from FY March 2014) | % | - | 15.5 | 13.6 | 16.2 |

Greenhouse Gas Emissions per Vehicle Produced

| Unit | FY March 2014 (base year) |

FY March 2023 | FY March 2024 | FY March 2025 | |

|---|---|---|---|---|---|

| Global production volume | Units | 1,269,296 | 1,134,982 | 1,219,139 | 1,207,069 |

| Greenhouse gas emissions per vehicle produced | t-CO₂e per unit | 0.731 | 0.691 | 0.658 | 0.645 |

| Reduction (from FY March 2014) | % | - | 5.5 | 10.1 | 11.9 |

Energy Consumption and Use of Renewable Energy-Derived Electricity

| Unit | FY March 2023 | FY March 2024 | FY March 2025 | |||

|---|---|---|---|---|---|---|

| Directly operated factories worldwide | Energy consumption | MWh | 2,975,150 | 2,803,330 | 2,659,155 | |

| Renewable energy consumption | MWh | 4,923 | 7,395 | 15,086 | ||

| Renewable energy usage ratio | % | 0.2 | 0.3 | 0.6 | ||

| Four domestic production sites | Energy consumption | MWh | 2,144,465 | 2,092,415 | 1,904,582 | |

| Renewable energy consumption | MWh | 1,948 | 4,130 | 6,368 | ||

| Renewable energy usage ratio | % | 0.1 | 0.2 | 0.3 | ||

| Overseas factories | Energy consumption | MWh | 830,686 | 710,915 | 754,573 | |

| Renewable energy consumption | MWh | 2,975 | 3,265 | 8,718 | ||

| Renewable energy usage ratio | % | 0.4 | 0.5 | 1.2 | ||

* Scope: Four Mazda Motor Corporation domestic production sites (headquarters factory; Hofu Plant, Nishinoura District, Hofu Plant, Nakanoseki District; and Miyoshi Plant) and six overseas production companies (two consolidated subsidiaries and four equity-method affiliates)

Directly Operated Factories and Offices in Japan*

Scope 1 and Scope 2 Greenhouse Gas Emissions

| Unit | FY March 2014 (base year) |

FY March 2024 | FY March 2025 | |

|---|---|---|---|---|

| Total Scope 1 and Scope 2 emissions | 1,000t-CO₂e | 854 | 667 | 649 |

| Reduction (from FY March 2014) | % | - | 22 | 24 |

* Scope: Sites including Mazda's Head Office and Hiroshima Plant (Aki-gun and Hiroshima City in Hiroshima Prefecture), Hofu Plant (Hofu City, Yamaguchi Prefecture), and Miyoshi Plant (Miyoshi City, Hiroshima Prefecture)

<Conservation of Water Resources>

Water is essential in automobile manufacturing processes such as cooling (e.g., cooling furnaces in casting), dilution (dilution of the mother liquor used for cutting and cleaning in the machining process), and cleaning (e.g., cleaning of vehicle bodies in the painting process). In preparation for potential risks and concerns for the future related to matters such as water resources depletion and rising water prices, we are testing water resource reuse and recycling initiatives to be deployed on a wider scale in 2030 at a domestic model plant. By 2050, we aim to implement these initiatives throughout our global production processes.

■Major Metrics and Targets

| Target for FY March 2031 | Reduce water intake by domestic Mazda Group companies by 38% compared to FY March 2014 |

|---|

■Progress Related to Water Resources Conservation Metrics and Targets

Water Intake (Domestic Mazda Group Companies)

| Unit | FY March 2014 (base year) |

FY March 2021 | FY March 2022 | FY March 2023 | FY March 2024 | FY March 2025 | |

|---|---|---|---|---|---|---|---|

| Water intake | 1,000㎥ | 9,244 | 6,659 | 6,424 | 6,402 | 6,475 | 5,869 |

| Reduction (from FY March 2014) | % | ‐ | 28 | 31 | 31 | 30 | 37 |

Scope for FY March 2025: Mazda Motor Corporation, 20 domestic consolidated subsidiaries, and 10 domestic equity-method affiliates