FY March 2025 Financial Results were announced on May 12, 2025

LATEST RESULTS HIGHLIGHTS

The Latest Financial Results

FY March 2025 Results

| (Billion Yen) | FY March 2024 | FY March 2025 | Change from Prior Year | Change from Feb. Forecast | |

|---|---|---|---|---|---|

| Full Year | Full Year | Full Year | Full Year | ||

| Global Sales Volume (Thousand Units) | 1,241 | 1,303 | +62 | +5% | -27 |

| Consolidated Wholesales (Thousand Units) | 1,202 | 1,219 | +17 | +1% | -31 |

| Net Sales | 4,827.7 | 5,018.9 | +191.2 | +4% | +18.9 |

| Operating Income | 250.5 | 186.1 | -64.4 | -26% | -13.9 |

| Ordinary Income | 320.1 | 189.0 | -131.1 | -41% | -1.0 |

| Net Income | 207.7 | 114.1 | -93.6 | -45% | -25.9 |

| Operating Return on Sales | 5.2% | 3.7% | -1.5pts | -0.3pts | |

| EPS(Yen) | 329.6 | 181.0 | -148.6 | -41.1 | |

Exchange Rate (Yen) US Dollar Euro Thai Baht Mexico Peso |

145 157 4.11 8.35 |

153 164 4.38 8.02 |

+8 +7 +0.27 -0.33 |

0 0 +0.02 -0.01 | |

*Net income indicates net income attributable to owners of the parent

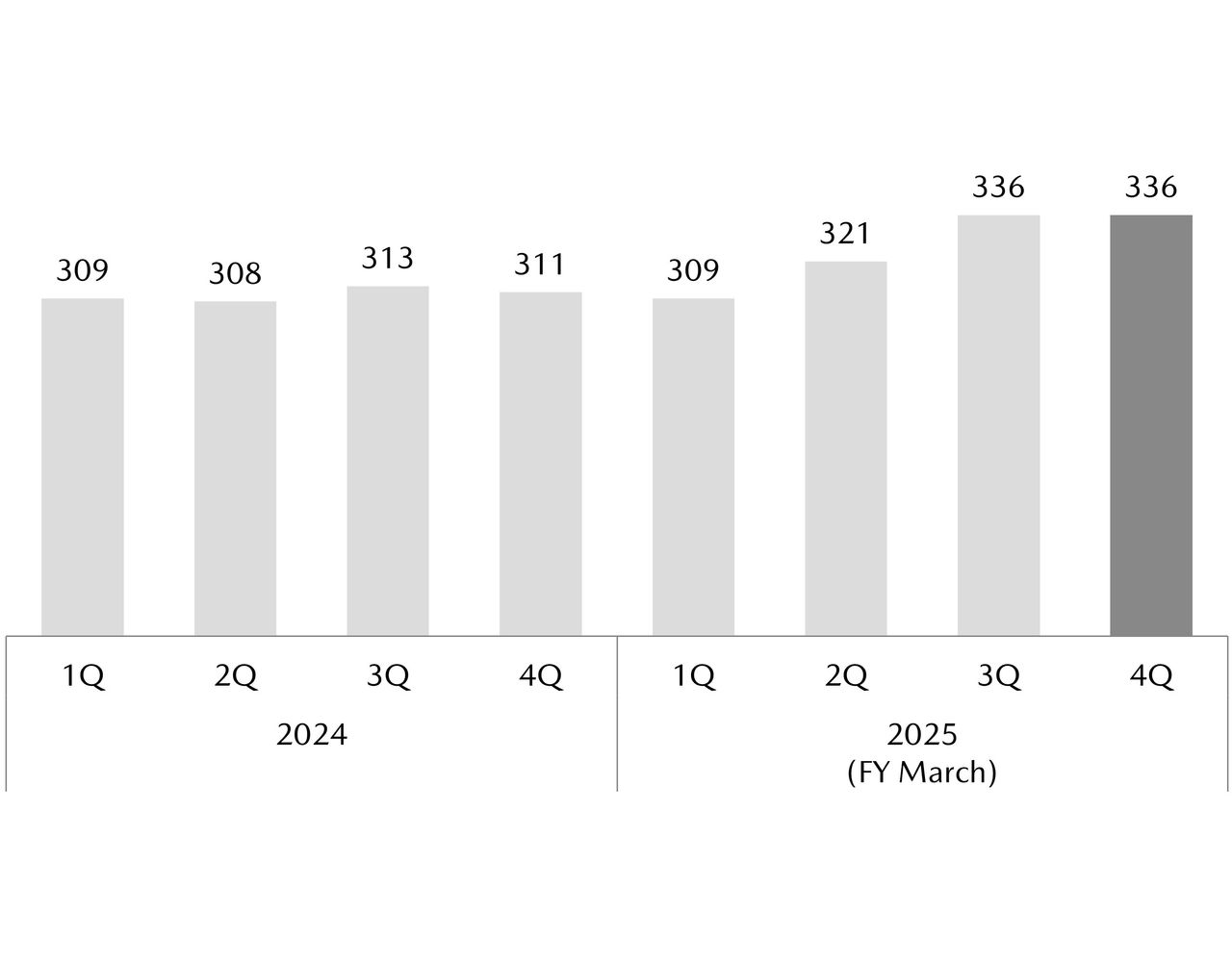

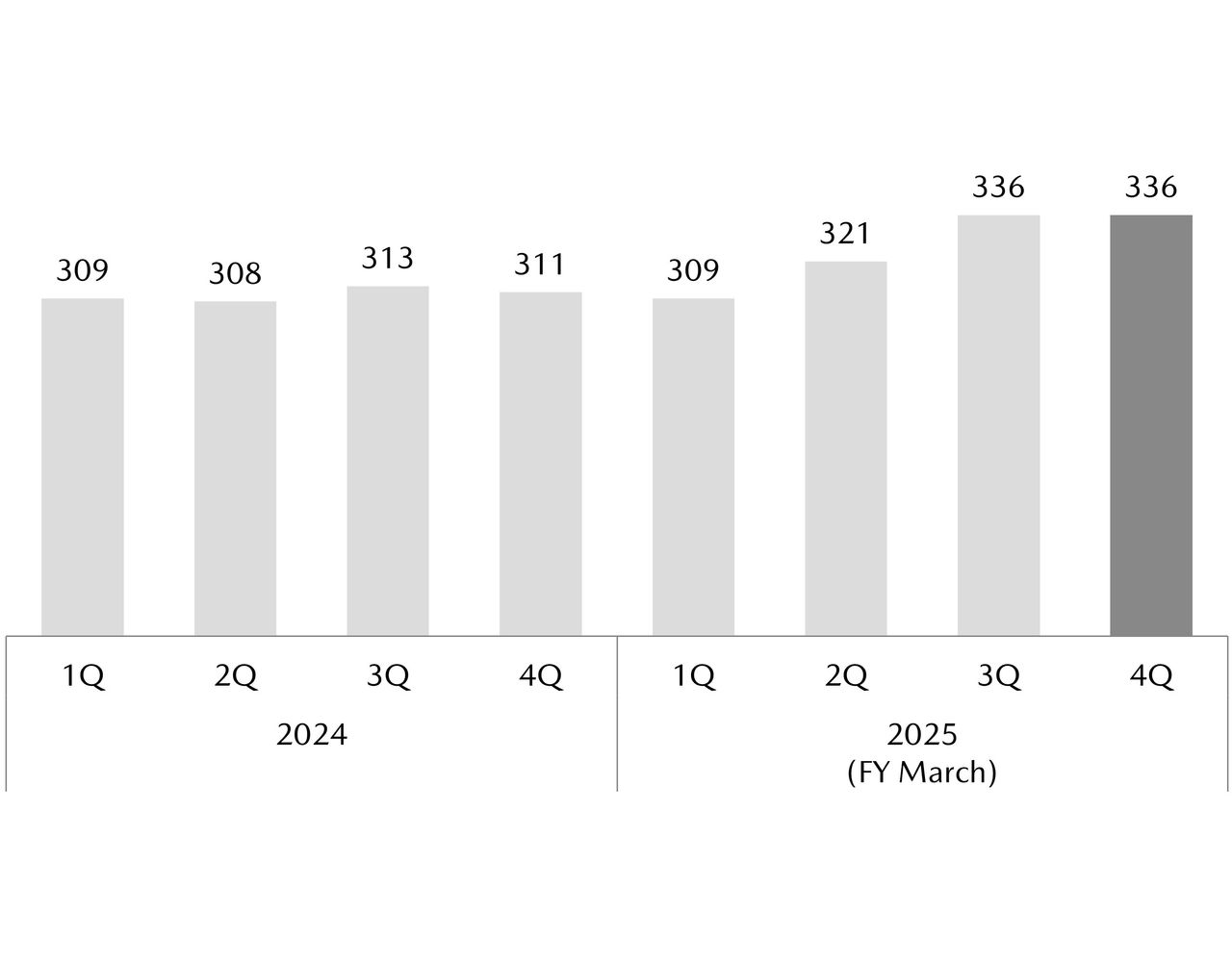

For the fiscal year ended March 31, 2025 (April 1, 2024 through March 31, 2025), global sales volume was 1,303,000 units, up 5% year on year.

Consolidated wholesale volume was 1,219,000 units, up 17,000 units year on year.

Net sales were ¥5,018.9 billion, up 4% from the prior year, and operating income was ¥186.1 billion, down 26% from the prior year. Net income attributable to owners of the parent was ¥114.1 billion, down 45% from the prior year.

Record sales in North America drove top-line growth. Operating income declined compared to the prior year, due to intensified global competition and a decrease in wholesales, as we made all-out efforts to address quality issues.

Fiscal year March 2025 marked the final year of Phase 1 under our 2030 Management Policy. On the product side, we launched a hybrid variant of the CX-50 and Large models such as the CX-80, and we introduced into the market the Mazda EZ-6, a model jointly developed with Changan Automobile.

Also, we made solid progress as planned towards Phase 2 with strengthening our R&D and manufacturing innovation for electrification, as well as laying the foundation for reducing costs.

Average exchange rates for the period were ¥153 to the US dollar, ¥8 weaker from the prior year and ¥164 to the euro, ¥7 weaker from the prior year.

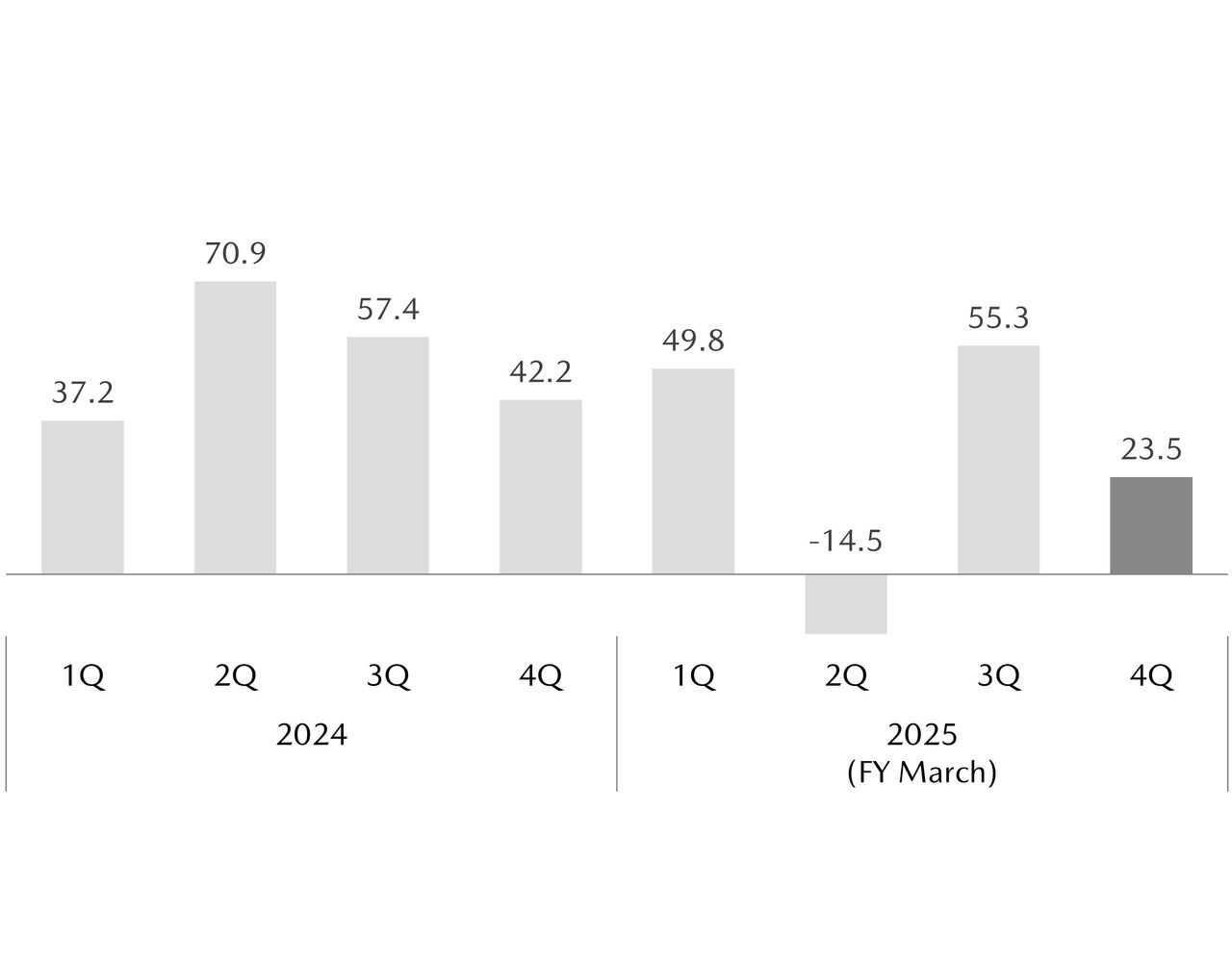

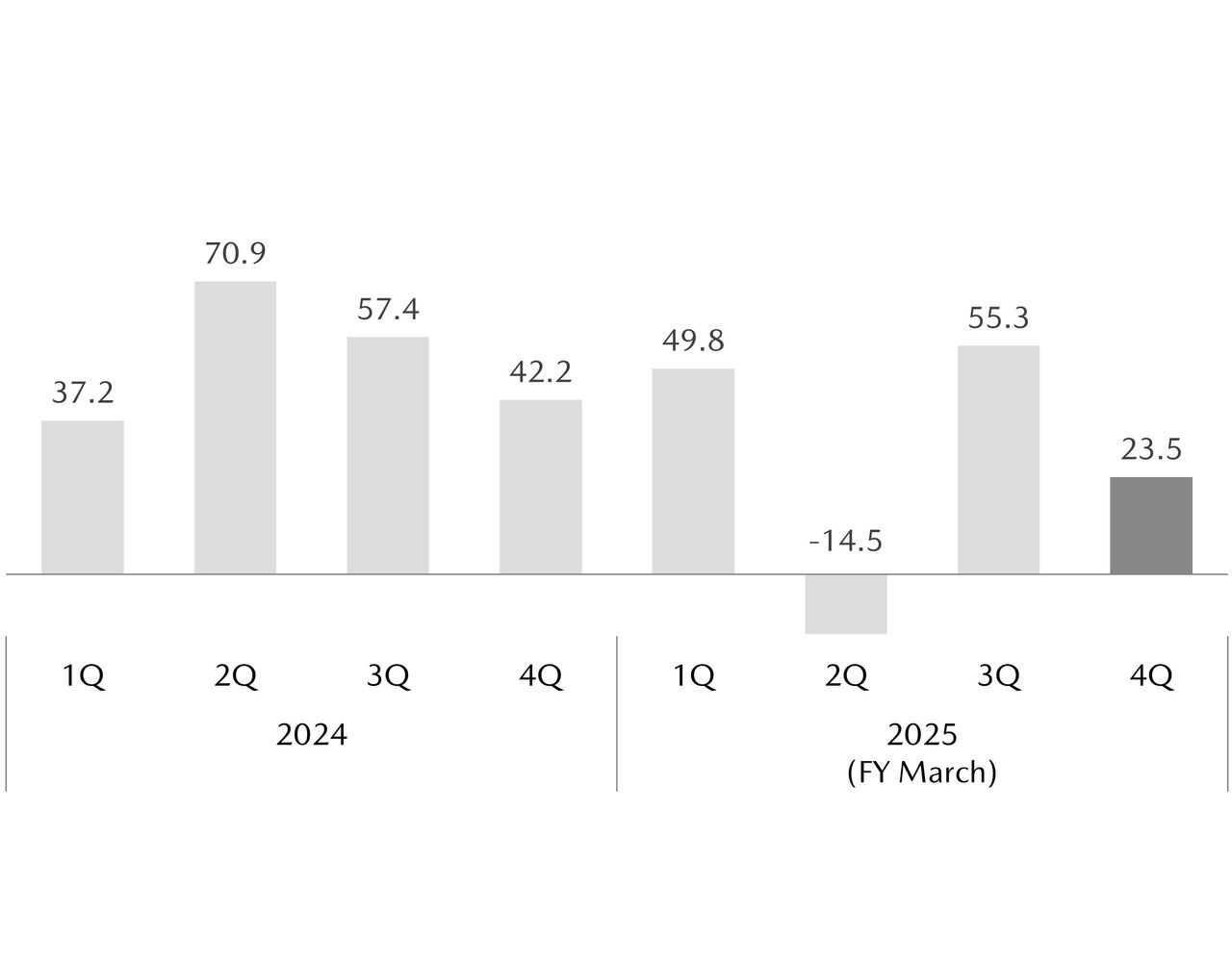

Graphs displaying results and financial data

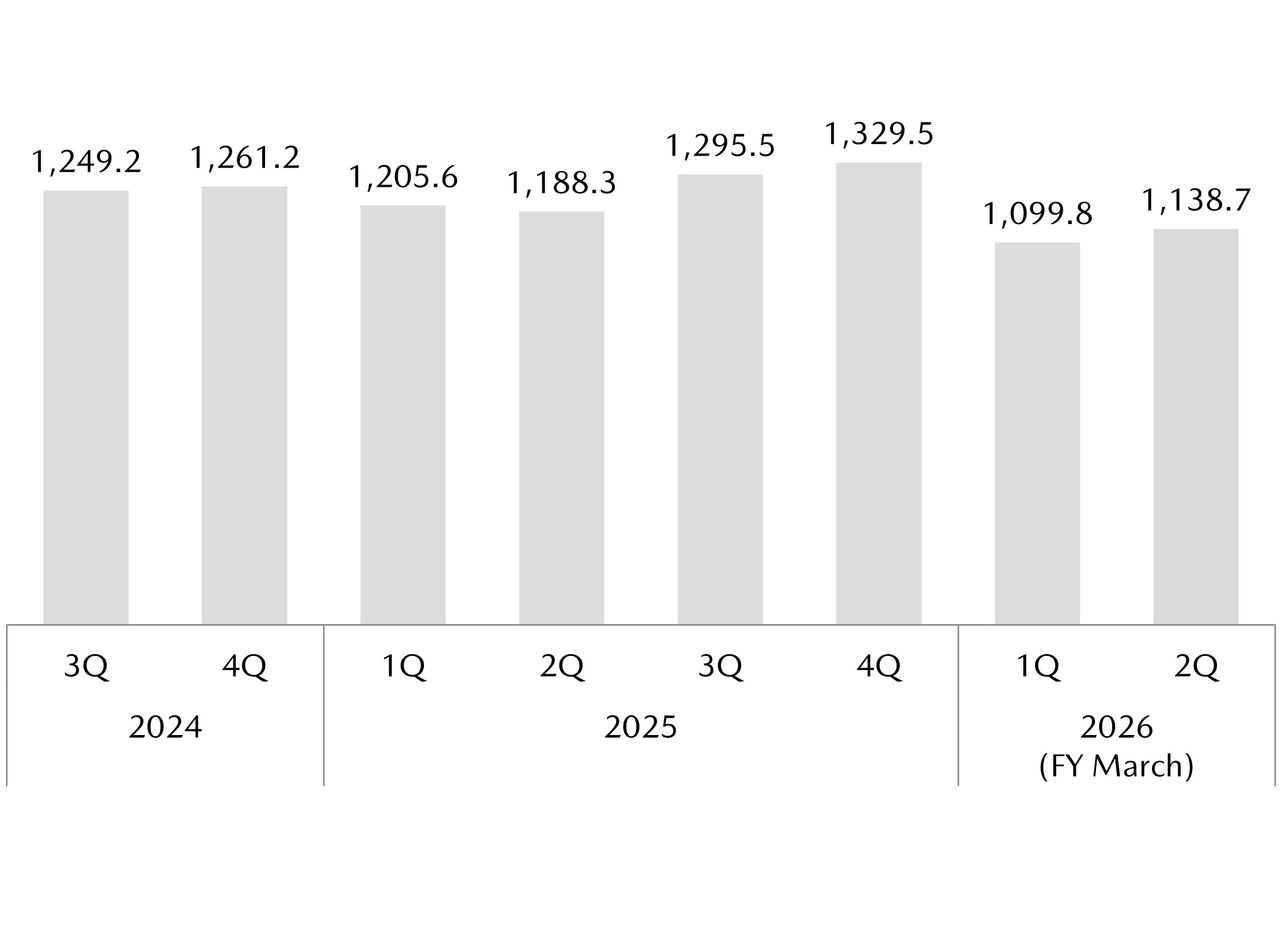

Global sales volume (Thousands of Units)

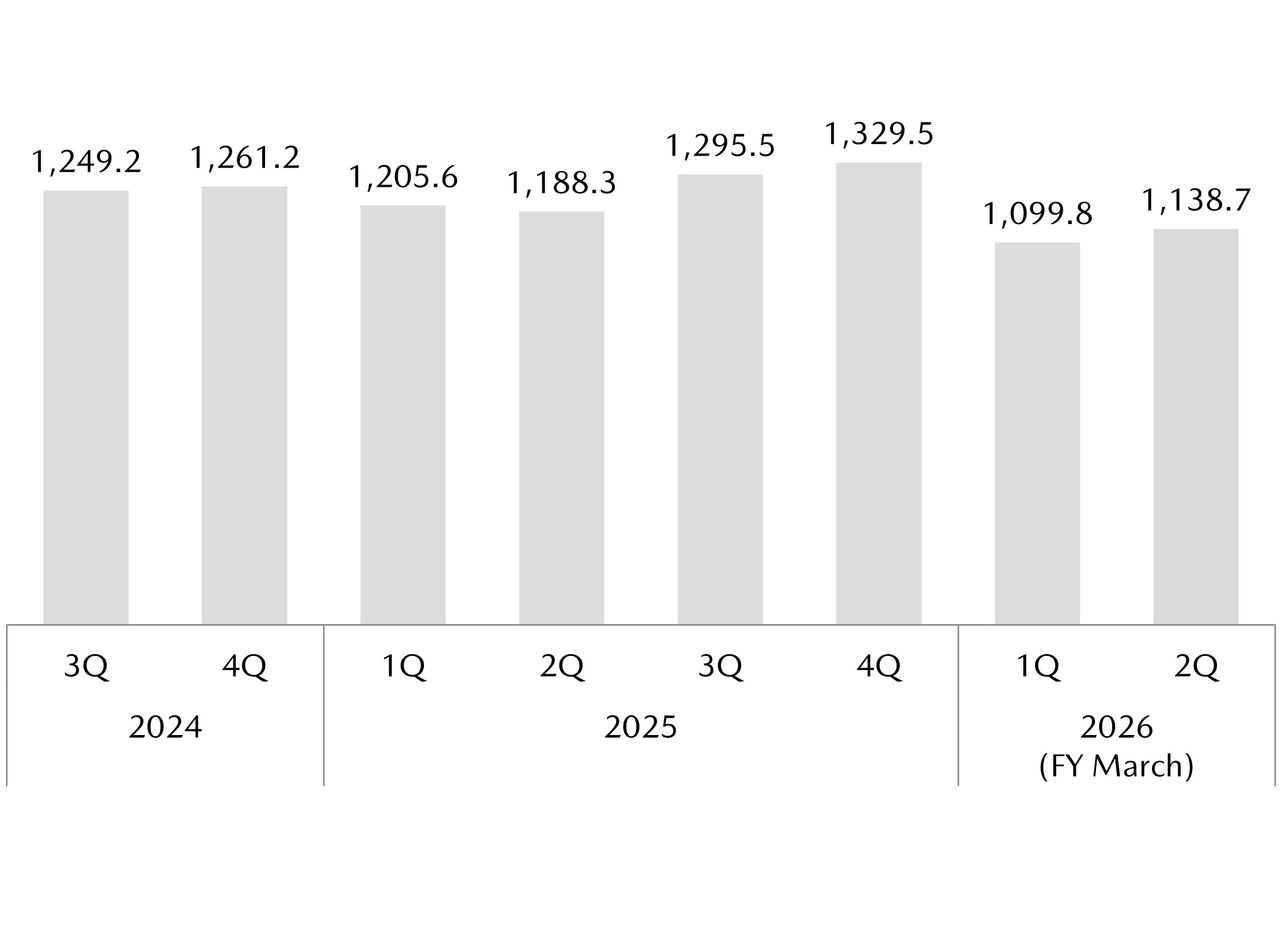

Net Sales (Billions of Yen)

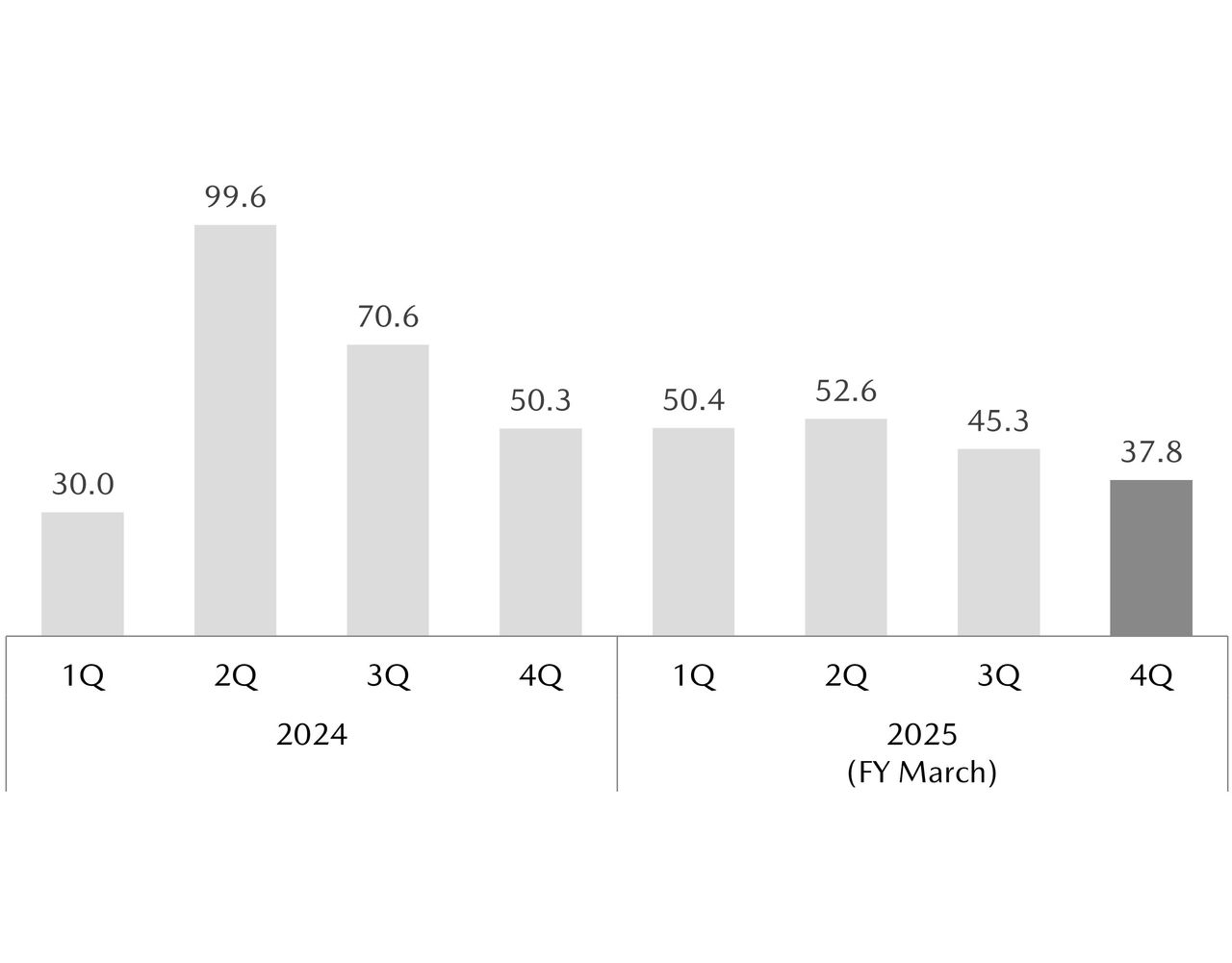

Operating Income (Billions of Yen)

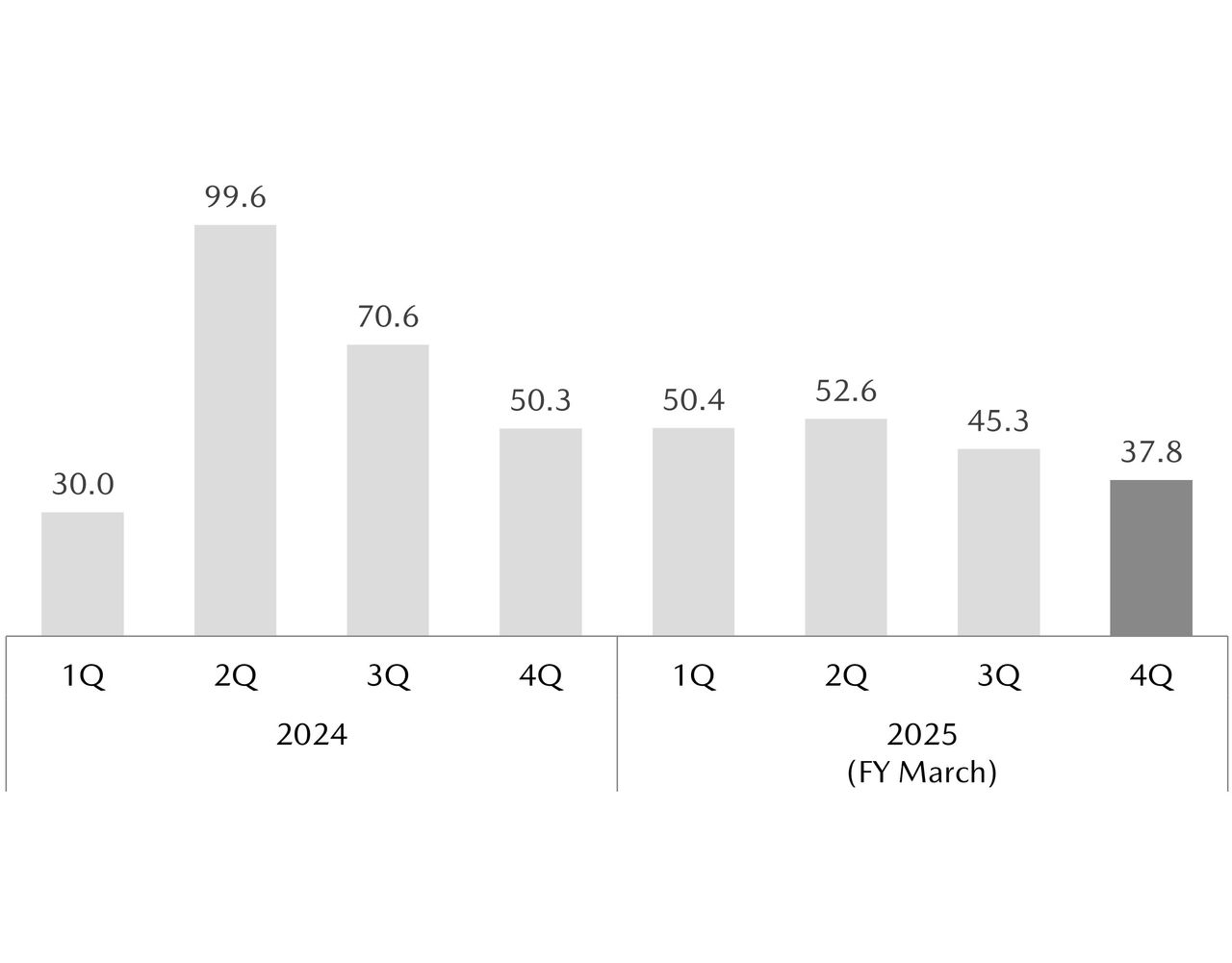

Net Income Attributable to Owners of the Parent (Billions of Yen)