FY March 2026 Third Quarter Financial Results were announced on February 10, 2026

LATEST RESULTS HIGHLIGHTS

The Latest Financial Results

FY March 2026 Nine Month Results

| (Billion Yen) | FY March 2025 | FY March 2026 | Change from Previous Year | |||

|---|---|---|---|---|---|---|

| Nine Month | First Half | Third Quarter | Nine Month | Nine Month | ||

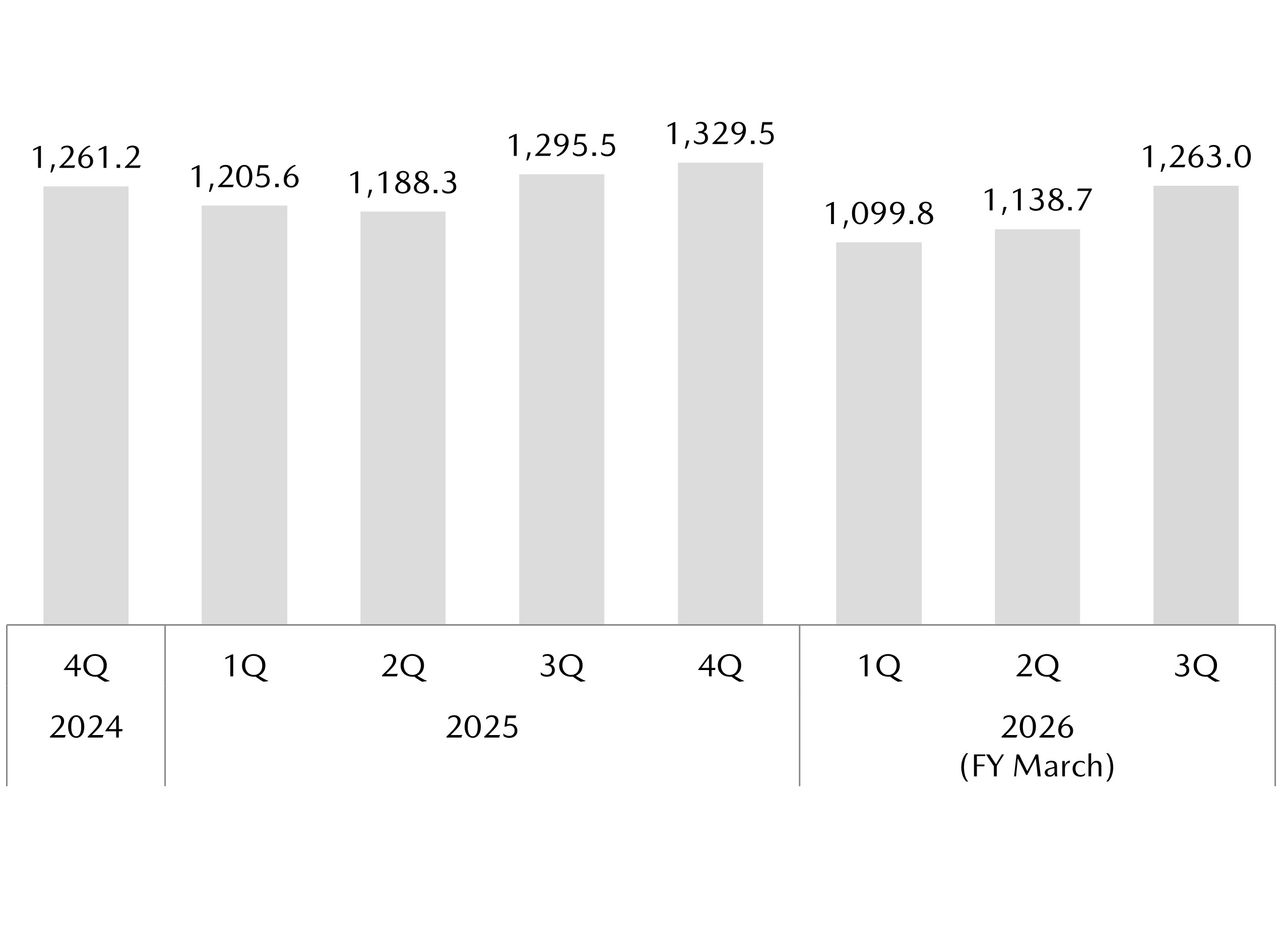

| Global Sales Volume (Thousand Units) | 966 | 609 | 311 | 920 | -46 | -5% |

| Consolidated Wholesales (Thousand Units) | 902 | 543 | 291 | 834 | -69 | -8% |

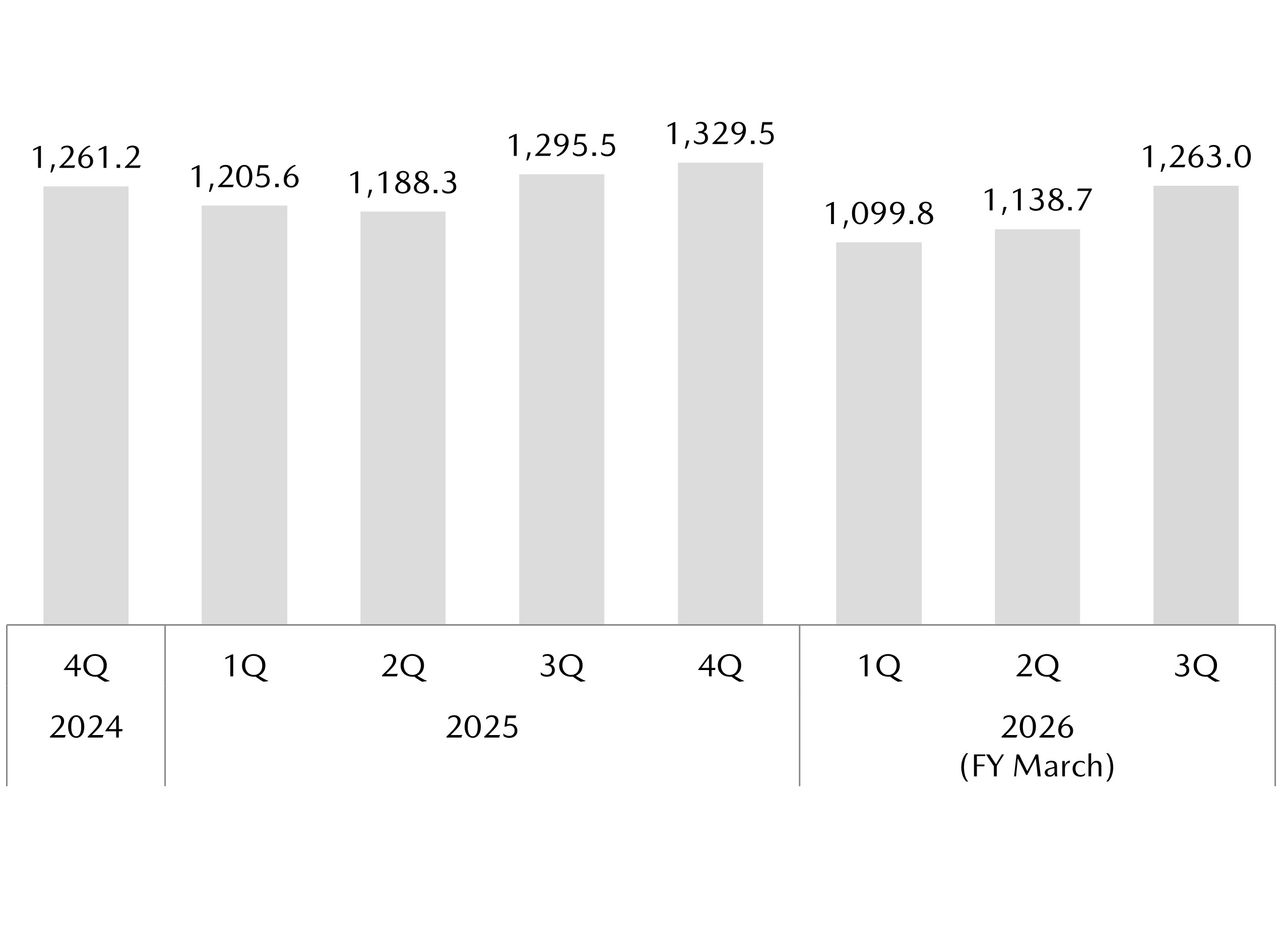

| Net Sales | 3,689.4 | 2,238.5 | 1,263.0 | 3,501.5 | -187.9 | -5% |

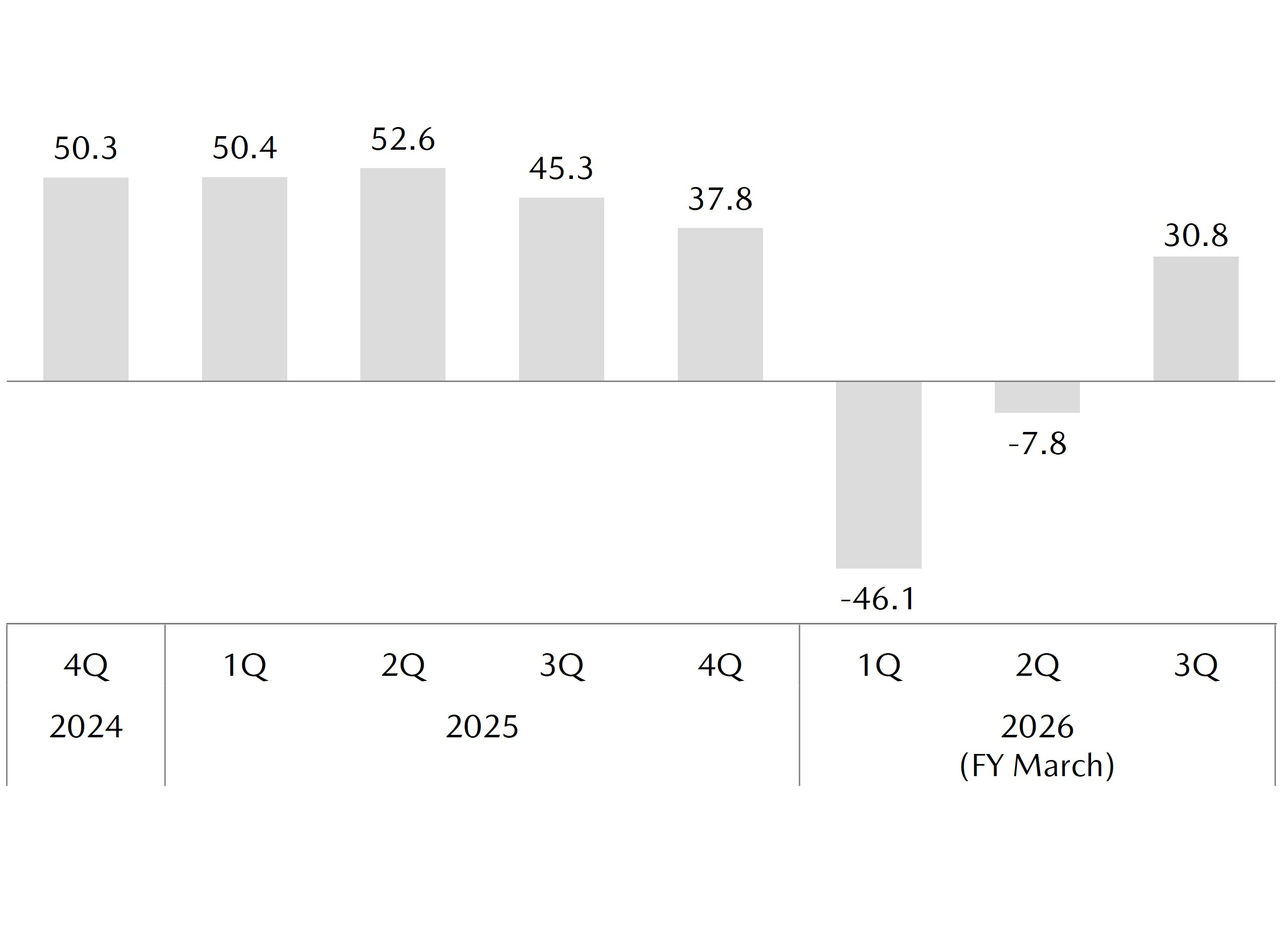

| Operating Income | 148.3 | -53.9 | 30.8 | -23.1 | -171.4 | - |

| Ordinary Income | 156.8 | -21.3 | 58.7 | 37.4 | -119.4 | -76% |

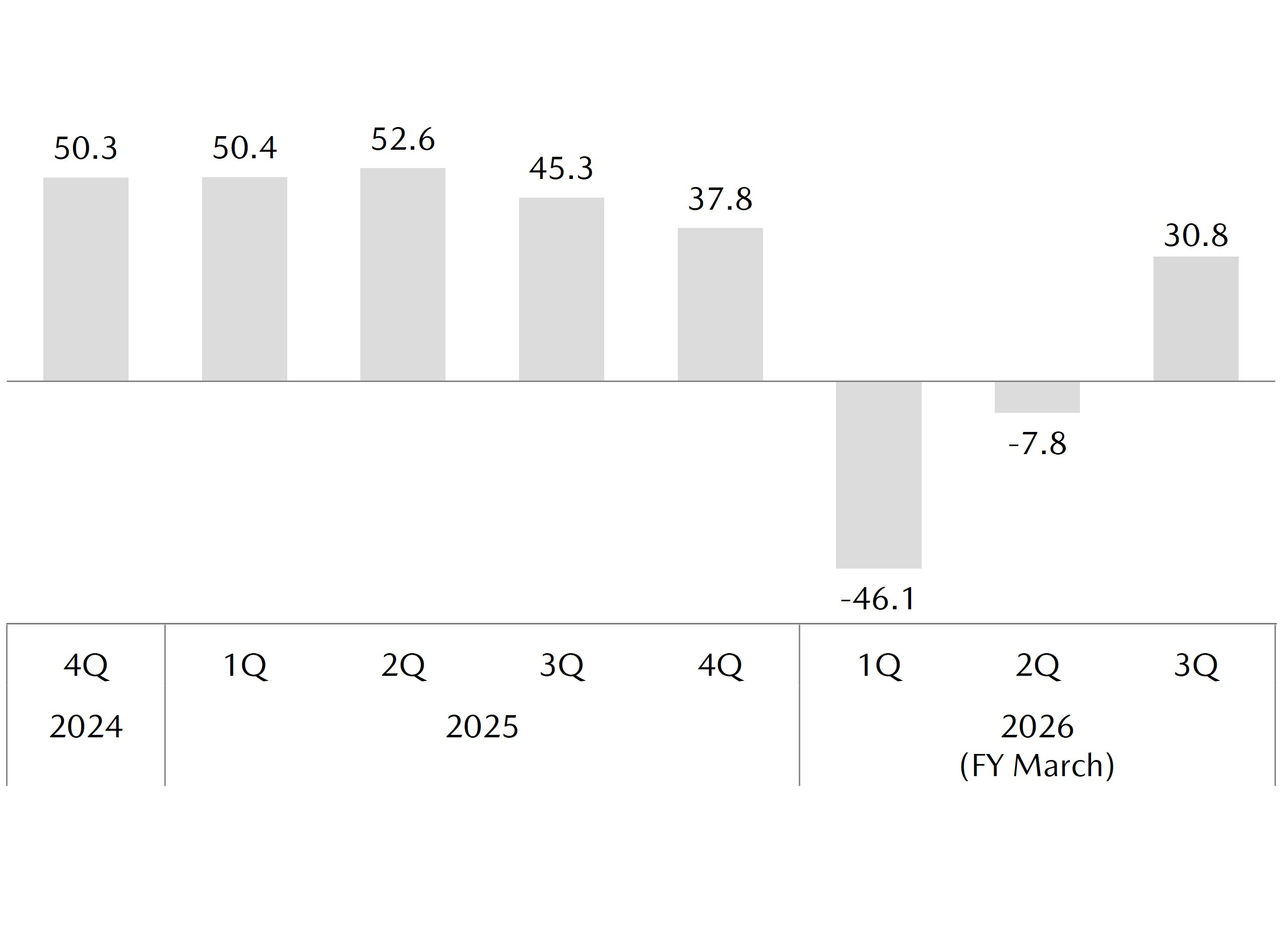

| Net Income | 90.6 | -45.3 | 30.6 | -14.7 | -105.3 | - |

| Operating Return on Sales | 4.0% | -2.4% | 2.4% | -0.7% | -4.7pts | |

| EPS(Yen) | 143.7 | -71.8 | 48.5 | 23.3 | -167.0 | |

| Free Cash Flow | 73.1 | -150.7 | 4.9 | -145.8 | ||

Exchange Rate (Yen) US Dollar Euro Thai Baht Mexican Peso |

153 165 4.34 8.19 |

146 168 4.47 7.67 |

154 179 4.80 8.43 |

149 172 4.58 7.92 |

-4 +7 +0.23 -0.27 | |

*Net income indicates net income attributable to owners of the parent

For the first nine months of fiscal year ending March 31, 2026 (April 1, 2025 through December 31, 2025), global sales volume was 920,000 units, down 5% year on year. This primarily reflects lower sales in the U.S. and Europe.

Consolidated wholesale volume was 834,000 units, down 8% year on year, showing progress generally in line with our plan and reflecting reduced production in light of the uncertain economic environment and tariff conditions in the U.S. Net sales were ¥3,501.5 billion, down 5% from the prior year, operating loss was ¥23.1 billion, and net loss attributable to owners of the parent was ¥14.7 billion.

We achieved profits as planned and returned to profitability in the third quarter, recording positive operating income, net income attributable to owners of the parent, and free cash flow for the three-month period.

Average exchange rates for the period were ¥149 to the U.S. dollar, ¥4 stronger from the prior year and ¥172 to the euro, ¥7 weaker from the prior year.

FY March 2026 FORECAST

| (Billion Yen) | FY March 2025 | FY March 2026 | Change from Previous Year | Change from Nov. Forecast | |

|---|---|---|---|---|---|

| Full Year | Full Year | Full Year | Full Year | ||

| Global Sales Volume (Thousand Units) | 1,303 | 1,280 | -23 | -2% | -20 |

| Consolidated Wholesales (Thousand Units) | 1,219 | 1,172 | -46 | -4% | -20 |

| Net Sales | 5,018.9 | 4,820.0 | -198.9 | -4% | -80.0 |

| Operating Income | 186.1 | 50.0 | -136.1 | -73% | 0.0 |

| Ordinary Income | 189.0 | 78.0 | -111.0 | -59% | +10.0 |

| Net Income | 114.1 | 20.0 | -94.1 | -82% | 0.0 |

| Operating Return on Sales | 3.7% | 1.0% | -2.7pts | 0.0pts | |

| EPS(Yen) | 181.0 | 31.7 | -149.3 | 0.0 | |

Exchange Rate (Yen) US Dollar Euro Thai Baht Mexican Peso |

153 164 4.38 8.02 |

150 174 4.64 8.07 |

-2 +10 +0.26 +0.05 |

+3 +3 +0.10 +0.20 | |

*Net income indicates net income attributable to owners of the parent

For the fiscal year ending March 31, 2026 (April 1, 2025 through March 31, 2026), we have updated our global sales volume forecasts by market to reflect recent sales trends to 1.28 million units.

Consolidated wholesales will be under 1.2 million units, reflecting primarily the delayed shipment of the new CX-5 due to an extended period of quality confirmation, as well as adjustments to sales in Other Markets.

Although net sales are revised to ¥4,820 billion, down 4% from the prior year due to the lower wholesales, operating income is at ¥50 billion and net income attributable to owners of the parent is ¥20 billion, unchanged from November forecast.

Our exchange rate assumptions are ¥150 to the U.S. dollar, ¥2 stronger from the prior year, and ¥174 to the euro, ¥10 weaker from the prior year.

We started production of the new CX-5 in December. This fiscal year, we will launch the new model in Europe and North America. Deliveries begin in this fourth quarter, and order intake and dealer enthusiasm are in line with our expectations. We intend to introduce this new model globally in the next fiscal year during which we expect it to make a full-year contribution to sales and profits.

Graphs displaying results and financial data

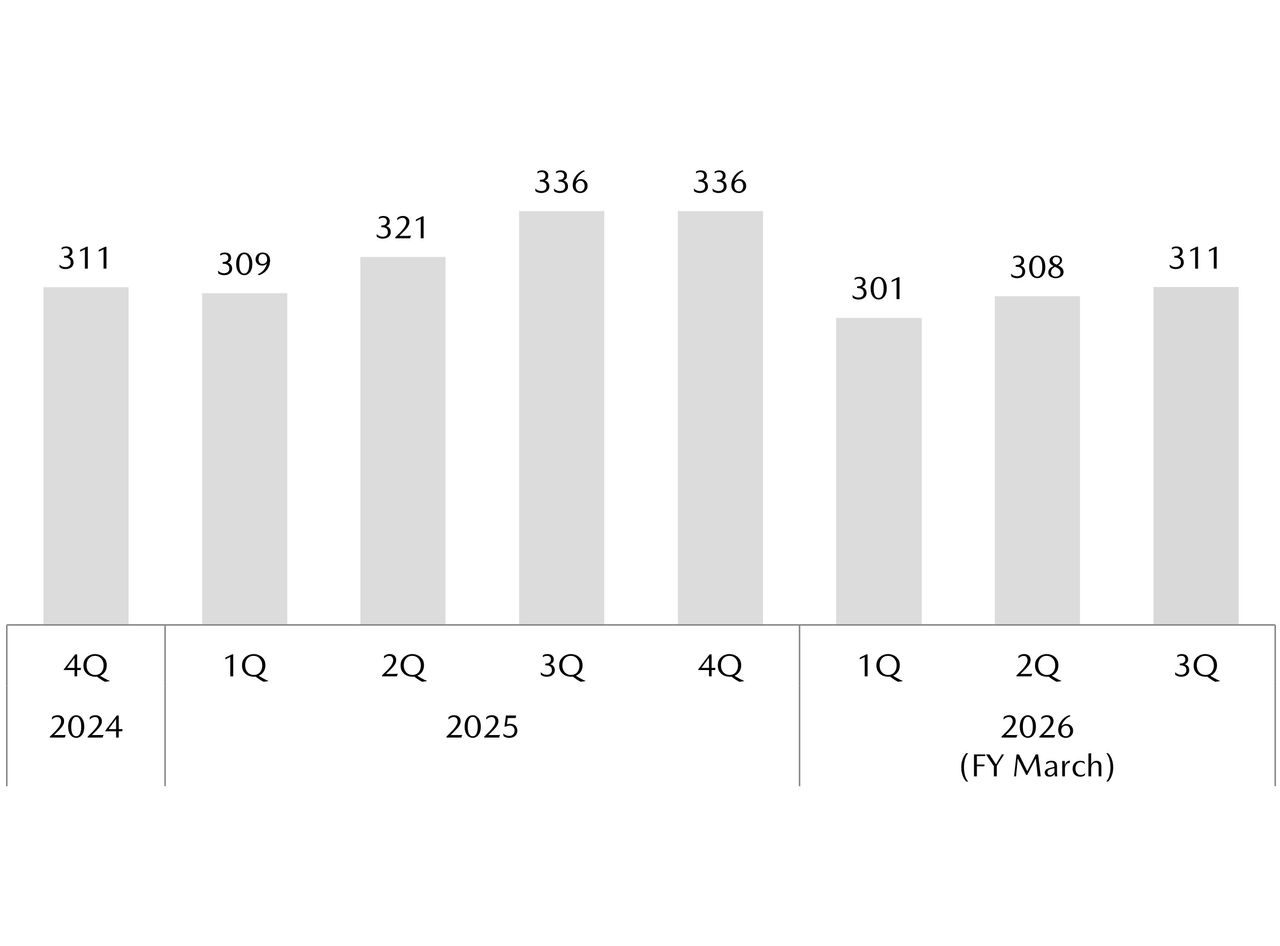

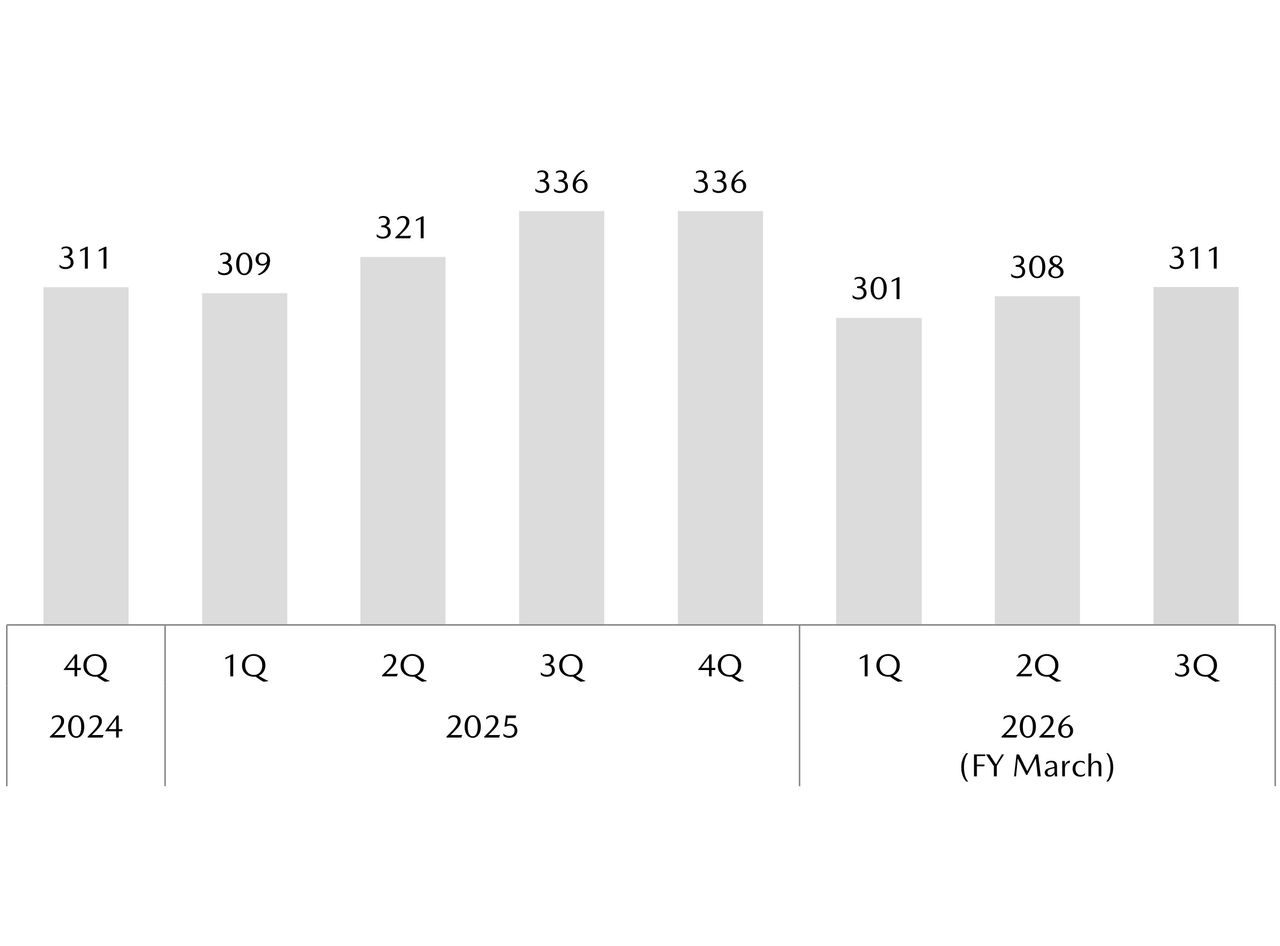

Global sales volume (Thousands of Units)

Net Sales (Billions of Yen)

Operating Income (Billions of Yen)

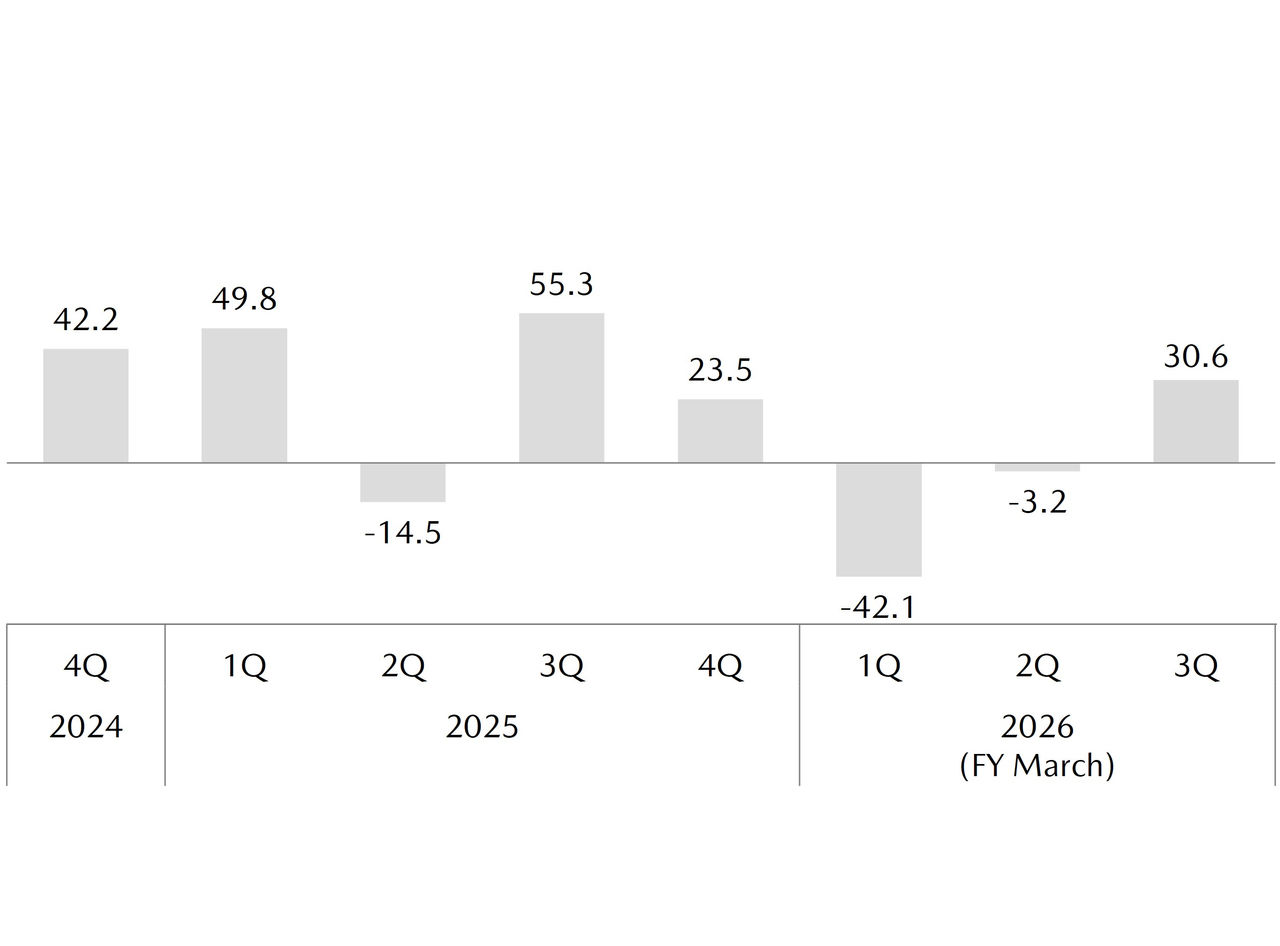

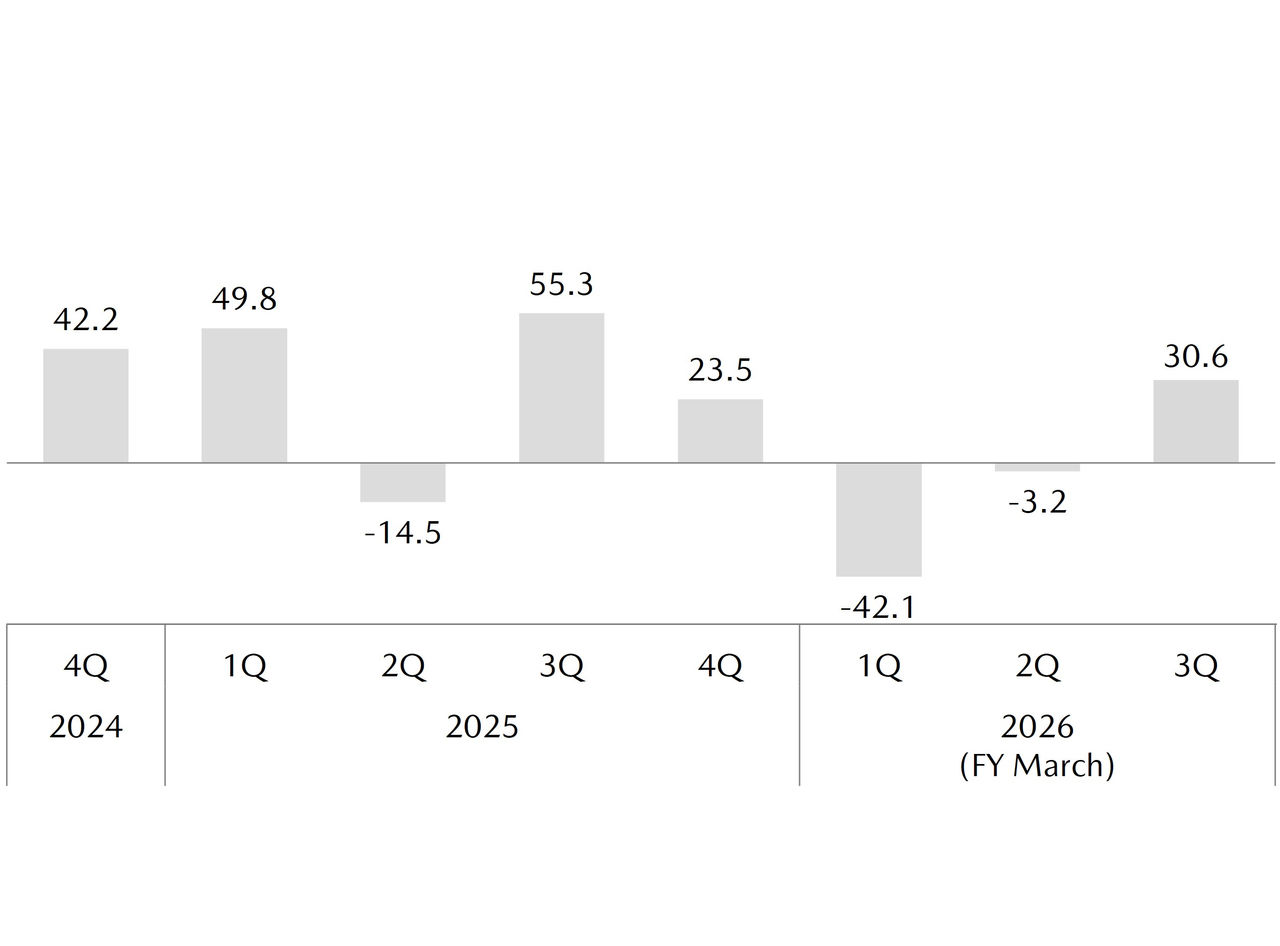

Net Income Attributable to Owners of the Parent (Billions of Yen)